The Health Service in France

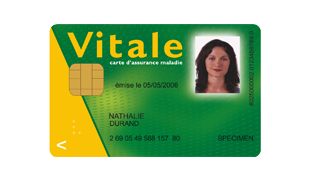

The French health system for residents all revolves around the famous green and aptly named ‘Carte Vitale’

For those who move to France and are not covered by any of the above, there are two basic options. Either you obtain state health cover and a Carte Vitale, or you pay for private health insurance! Technically you don’t have the right to live here if you don’t have health cover.

By far the easiest way to get a Social Security number and a Carte Vitale is to get a salaried job. Needless to say this is not easy for many new arrivals, not least if you don’t speak French! If you are one of the lucky ones, your employer will get the ball rolling but you will also have to contact the CPAM, Caisse Primaire Assurance Maladie, in your department. They send all the necessary forms, you have to register with a doctor, fill in and send the forms, and after a short delay you should have your Carte Vitale.

The other way to get health cover in France is to start a business, but even then you might not get a Carte Vitale immediately, read on....

If you start as an ‘auto-entrepreneur’, which is easy and can be done online, you get your SIRET/SIREN number and can start work immediately (although there are some restrictions on the type of work you can do, how much you have to pay in social cotisations, what insurance you can obtain etc and these rules are subject to constant change!) However, this system was really designed for French people and those already ‘in the system’. In theory you and your family should be covered immediately when you start as an auto-entrepreneur, in practice it can take quite some time and require extra letters and documents.

If you are thinking about starting a EURL (sole trader, company with one director) , starting or buying an existing SARL (company with more than one director) you really need to take advice from an accountant or specialist company dealing with helping to start new businesses. They will be able to advise on your position vis a vis the health system.

Another way to immediately ‘get into the system’ is to start a ‘micro-entreprise’ This can be done via the Chambre de Metiers for those working in regulated trades and via the Chambre de Commerce in your department for other types of work. A micro-entreprise allows you to earn a certain amount per year (currently about 32k euros for your services and about 86k euros for sales or sales/services combined) The social charges you pay are eventually calculated accurately based on your earnings, but for the first couple of years you pay a standard amount which covers all your social contributions, including health. Thus you are immediately entitled to a Carte Vitale for you and your family and you start paying towards a (often small) state pension. However, the charges, depending on your trade, whether you are obliged to pay pension contributions etc, can amount to 6000 euros a year, very approximately. So... unless you have adequate capital to cover these payments as you build your business, or unless you are sure you can make enough money from day one, starting a micro-entreprise may not be for you. Again an accountant or specialist advisor can help you with this decision. Fewer micro-entreprises are created these days since the start of the auto-entrepreneur regime.

So let’s say you have obtained your Carte Vitale - what happens then?

Basically, when you visit the doctor, hospital, a specialist, dentist etc, the Carte Vitale covers a set proportion of the cost, usually 67%. Sometimes you pay this at the time and are given a form to send off to claim it back, sometimes you pay it but the relevant amount is automatically refunded into your bank account, sometimes you don’t pay it at all and the bill is paid automatically behind the scenes. Which of these happens depends on the agreement the particular doctor, hospital etc has with the authorities. The same goes for the bills for drugs and materials/equipment at the pharmacies, although in my experience these are usually set up better to claim the payments automatically, so you don’t normally need to pay at least the first 67% of the bill. You may have to pay 1 euro per prescription unless this is covered by a mutelle policy.

What is a 'Mutelle' and what is it for?

The balance, for both treatment and drugs, you either pay yourself of take out insurance in the form of a ‘Mutuelle’ or top-up insurance. Mutuelle policies vary in the amount they cost and the amount they cover. This is a case of ‘you get what you pay for’. You need to read the small print carefully to see what is actually covered, since when a Mutuelle says ‘100% cover’ for example, this is 100% of an amount set and agreed by the state. Particularly in the case of dentist and optician’s bills, the amount of the actual bill may be considerably higher and 100% of the state amount is often nothing like 100% of the actual bill! Again the actual method of you paying or not paying on the day, or being refunded at a later date, depends on the arrangements the Mutuelles have with the doctor/hospital/dentist/pharmacy etc.

It’s worth shopping around for quotes for Mutuelles and carefully comparing the cover they offer, since changing policies is not always straightforward. Some offer discounts for families for example, where you pay for the first two children but further children are included free. Others are targeted more towards older people. Be aware that your previous medical history may be asked about and taken into account.

European Carte d'Assurance Maladie

If you live in France and need a card to cover you when travelling elsewhere in Europe you simply need to contact your health care organisation, ie RSI (Regime Social des Independents) or the CPAM of your department for salaried people and almost everyone else.

If you need help on obtaining the Carte Vitale to which you believe you are entitled, getting your CEAM or with finding a Mutuelle, do get in touch to see whether and how I can help you.